Meet Our Attorneys

At Kaplan Scharf Law, our attorneys bring decades of combined experience in tax law, estate planning, and business structuring. Each team member shares a commitment to exceptional service and technical excellence.

-

Seth R. Kaplan began his career at major national and international law firms. He has over 25 years of experience and is admitted to the New York Bar, North Carolina Bar and Florida Bar. Seth has been recognized by his peers in the South Florida Legal Guide, Super Lawyers, and Florida Trend’s Legal Elite. He also holds the Accredited Estate Planner® (AEP®) designation. He concentrates his practice in the areas of tax and estate planning for high net worth individuals both domestic and international, wealth protection, planning for startups and tech businesses, and planned giving. His clients range from Gen X and Millennial entrepreneurs to private equity fund managers and public company executives to high net worth investors and retirees.

In addition to assisting individuals and families reduce their tax exposure and organize their affairs, Seth has been involved in planning and coordinating major gifts to national universities and other charitable organizations. Some of the organizations include the University of Miami, Cornell University, Drexel University, the University of Florida and Dartmouth College, as well as the United Way of Miami-Dade and the Greater Miami Jewish Federation. Seth works with a number of families, some for over 20 years, assisting them as a trusted advisor and dealing with issues including business succession planning and post-mortem tax planning, as well as real estate and corporate issues as they relate to tax planning. He also has been involved in the development of sophisticated business succession plans utilizing techniques such as intra-family carried interests and series LLCs, as well as the “Hub and Spoke approach” to combine estate planning and planned giving goals, based on the original Delta Airlines and FedEx models.

Seth has lectured extensively on topics that focus on personal tax planning, taxation of trusts, international planning, and high-impact charitable giving. He has spoken at the NYU Institute on Federal Taxation, the American Bar Association, Section of Taxation and for several professional advisor groups. He received his B.A. from Northwestern University, and LL.M. in Estate Planning and J.D. from the University of Miami School of Law.

-

Amy Scharf Kaplan is the founding partner of Kaplan Scharf Law PLLC, where she focuses her practice on bankruptcy, consumer protection, debt relief solutions and asset protection. With over 10 years of experience, Amy has guided many individuals and families through the Chapter 7 process. She has also counseled individuals with respect to consumer protection matters, including claims under the Fair Debt Collection Practices Act (FDCPA). She is known for her hands-on, client-centered approach and her dedication to protecting clients’ rights and helping them achieve a fresh financial start where needed.

Prior to founding Kaplan Scharf Law, Amy practiced with the law firms of Hagen and Hagen P.A. and The Law Office of Bonnie L. Canty, P.A., concentrating on bankruptcy and consumer protection matters throughout South Florida. She also served as in-house counsel for a real estate and title company, where she managed commercial closings, compliance, and corporate governance. Earlier in her career, Amy worked with a West Palm Beach law firm handling condominium and homeowner association matters.

Amy earned her Juris Doctor from the University of Miami School of Law, where she was a Moot Court Competition finalist and an active volunteer with both the Guardian Ad Litem program and the HIV Education & Law Project. She graduated cum laude from New York University with a Bachelor of Science degree. Before entering law, Amy was a clinical registered dietitian, completing her internship at Cornell Medical Center–New York Hospital and later working for the clinical department of the not-for-profit organization Housing Works, Inc. in New York City, New York.

She is admitted to practice in all Florida state courts, as well as the U.S. District Court for the Southern District of Florida. Amy is a member of the Bankruptcy Bar Association, the South Palm Beach County Bar Association, and the National Association of Consumer Bankruptcy Attorneys.

-

Benjamin Miller is Counsel to the firm’s Trusts & Estates, Private Wealth & Taxation, Tax Exempt Organizations and Business & Real Estate Taxation Practice Groups.

Benjamin focuses his practice on domestic and international tax and estate planning representing affluent individuals and families, as well as assisting corporate and individual fiduciaries with the administration of trusts and estates. Benjamin also handles complex domestic and international corporate and trust structures, implementing international reorganizations, FIRPTA withholding and entity classification elections. He also advises clients regarding the tax implications of their corporate structures. Specifically, Benjamin has advised clients regarding the eligibility of their Qualified Small Business Stock exemptions.

Prior to joining the firm, Benjamin worked for an AM Law 200 law firm, as well as for a sophisticated boutique international tax law firm, where he advised clients on a variety of domestic and international estate and tax matters as they related to both personal and corporate tax issues.

Benjamin earned his LL.M. in Taxation at the Chicago-Kent College of Law and received his Juris Doctor from the Florida International University College of Law. During law school, Benjamin interned for the Honorable Spencer Eig of the Eleventh Judicial Circuit Court of Florida.

-

David A. Lappin is a dedicated trusts & estates attorney with a deep understanding of estate planning, estate and trust administration, and tax matters. David received an LL.M. in Taxation from Georgetown University Law Center, a J.D. from The George Washington University Law School, and a B.A. in Political Science from the College of Charleston, and he brings a comprehensive and compassionate approach to estate planning.

David is licensed to practice in Florida and New York and is admitted to practice before the U.S. Tax Court. David offers clients expert guidance on a wide range of issues, including:

Estate Planning

Estate & Trust Administration

Asset Protection Planning

Estate & Gift Tax Planning

IRS Tax Disputes

Retirement Account Planning

Charitable Planning

Estate & Trust Litigation

David helps clients plan for the transition of wealth to future generations, protect their assets and minimize tax burdens. David takes immense pride in counseling clients through some of their most challenging personal decisions.

Before starting Lappin Estate Planning, David was an associate at two global law firms and clerked for the Honorable Robert P. Ruwe on the U.S. Tax Court.

David lives in Boca Raton, Florida with his wife and son. In his free time, he enjoys traveling, fishing, playing golf and cooking.

Education:

Georgetown University Law Center, LL.M. in Taxation with Distinction and Dean’s List Honors

The George Washington University, J.D. with Honors

College of Charleston, B.A., Political Science

Bar & Court Admissions:

U.S. Tax Court

Florida

New York

Consultants to the Firm

-

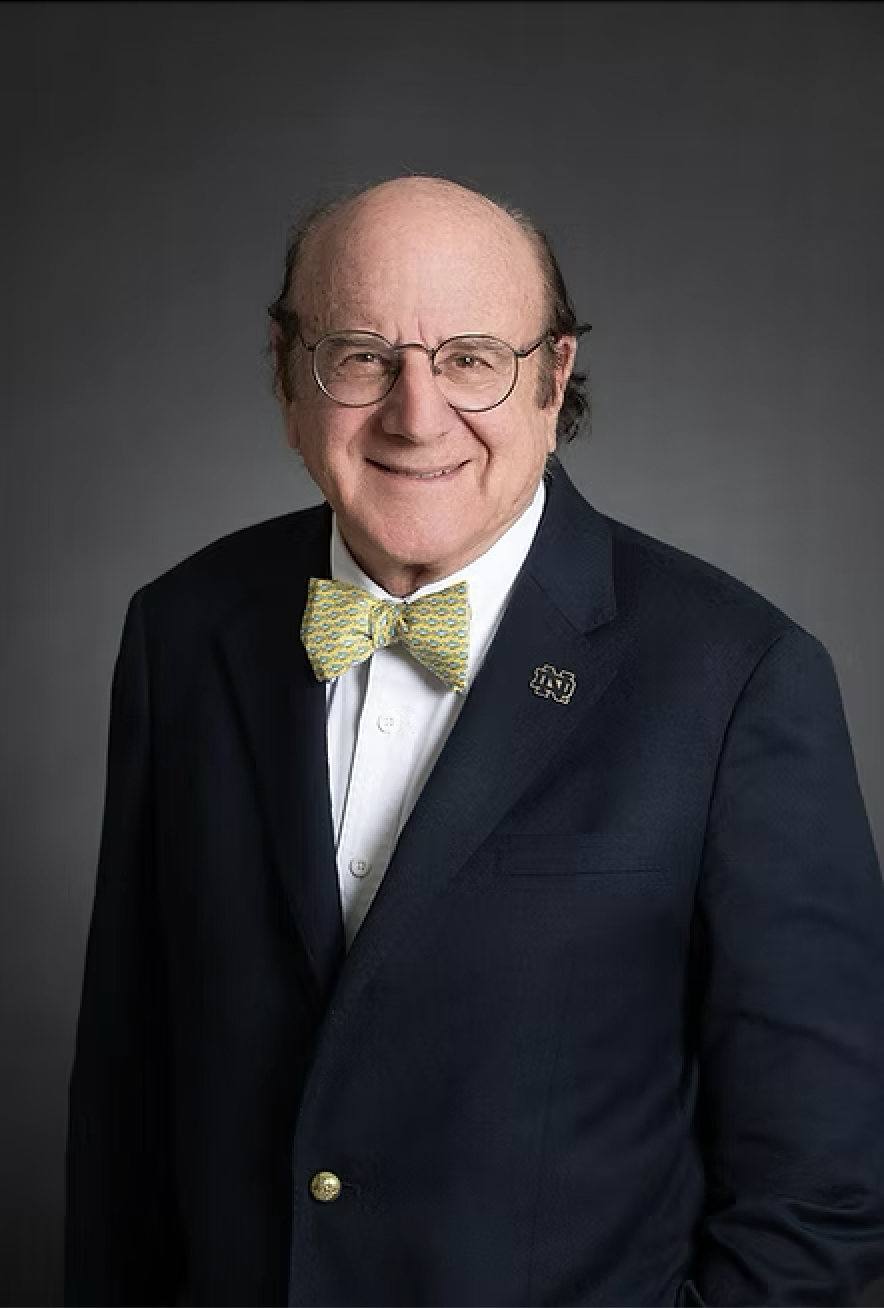

Jerome M. Hesch is Counsel to Meltzer, Lippe, Goldstein & Breitstone, LLP, where Seth Kaplan served as Managing Partner of the Boca Raton office from April 2021 - July 2025. Jerry is the Director of the Notre Dame Tax and Estate Planning Institute and is on the Tax Management Advisory Board. Jerry is a Fellow of the American College of Trusts and Estates Council and the American College of Tax Council. He is also a member of the NAEPC Estate Planning Hall of Fame. He has published numerous articles, Tax Management Portfolios, and co-authored a law school casebook on federal income taxation, now in its fourth edition. Jerry specializes in the areas of Business & Real Estate Taxation, Trusts & Estates, Tax Exempt Organizations and Private Wealth & Taxation Practice. Jerry presented papers for the University of Miami Heckerling Institute on Estate Planning, the University of Southern California Tax Institute, the Southern Federal Tax Conference and the New York University Institute on Federal Taxation, among others. He has participated in several bar association projects, including the Drafting Committee for the Revised Uniform Partnership Act. He was with the Office of Chief Counsel, Internal Revenue Service (1970-1975) and was a full-time law professor at the University of Miami School of Law and the Albany Law School of Union University for twenty years. He continues to teach courses as an adjunct law professor and has taught courses for Vanderbilt University Law School, University of Miami School of Law Graduate Program in Estate Planning, University of Buffalo School of Law, Florida International School of Law, On-Line LL.M. Programs for University of San Francisco Law School and Boston University School of Law. In addition, he was the Director of the Graduate Program in Estate Planning at the University of Miami from 1982-1992.

Both Seth and Benjamin Miller are former students of Jerry’s. Seth and Jerry have a working relationship going back almost 30 years and worked together at the law firms of Greenberg Traurig and Berger Singerman and then most recently at Meltzer Lippe. They have co-authored several articles and presented together on several occasions. Jerry is admitted to the Florida Bar and New York State Bar.